Kaspersky Fraud Prevention

Reduction of fraud risk for online and mobile financial transactions

Banking Environment

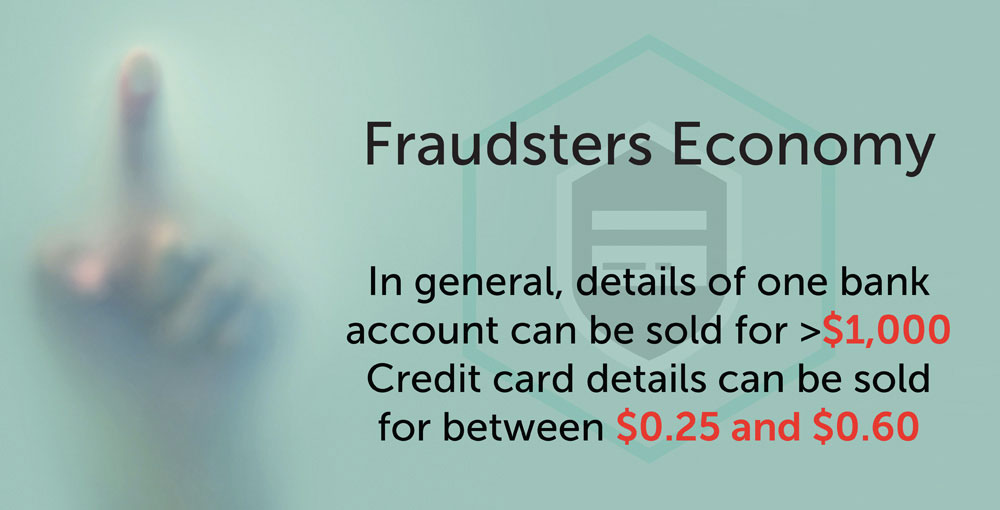

Banking & payments are increasingly going digital. Your customers are seeking freedom from branches and demanding the convenience of online & mobile banking. This trend benefits your bank by offering a higher margin channel through which you can provide anytime, anywhere access to more high-margin and high-retention services. At the same time, cybercriminals are continuously launching new ways to attack. So your bank needs rigorous fraud prevention – but not at the expense of a smooth banking experience for your customers.

Customer Errors Can Impact Your Reputation

It’s a sad fact of life. Your customers can be unpredictable and unreliable – especially when it comes to ensuring their computers and mobile phones are secure. However, their mistakes are still likely to be your problem. Every time one of your customers is attacked by an online fraudster, it’s your business that’s likely to suffer the most. It’s not just a case of you having to cover your customer’s financial loss, you could also see your business reputation damaged – even though you’ve done everything you thought possible to protect your own internal IT systems.

What We Offer

Kaspersky Fraud Prevention proactively protects against the root causes of digital banking fraud. It secures digital transactions, without damaging the customer experience:

Adds multi-channel security for digital banking & payments

Offer high margin services – without security concerns

Kaspersky Fraud Prevention Clientless Engine

Provides server-side technologies that protect 100% of your user base… no matter what device or platform your customers are using, we prevent infected devices accessing your systems

Helps protect 100% of users – regardless of device

Deliver more functionality & differentiate your brand

Kaspersky Fraud Prevention Mobile SDK

Protects mobile banking & payments apps on Android, iOS and Windows Phone devices. It safeguards customers’ account information and secures customer communications with your bank

Delivers ‘frictionless’ security, for a smoother user experience

Boost customer retention & win new customers

Kaspersky Fraud Prevention for Endpoints

Runs on your customers’ Windows PCs and Mac computers, to provide powerful protection root-cause prevention against malware and Internet-based attacks

What it Gives to Your Business

Insight & Visibility Into The Hygiene of Your Customers’ Devices

The Kaspersky Fraud Prevention Console delivers key information, insights, and statistics to better manage your fraud prevention strategy. Know which customers are protected or unprotected, and know which devices are infected or clean. Gain understanding of what threats your bank faces, what malware is attacking your bank, and what phishing attacks are targeting your customers.

Root-Cause Prevention That Focuses on Customer Experience